|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

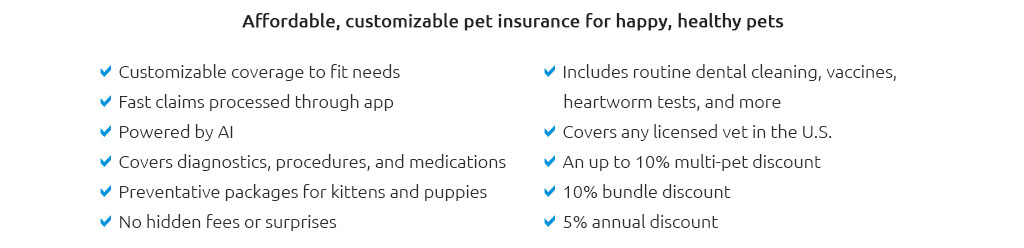

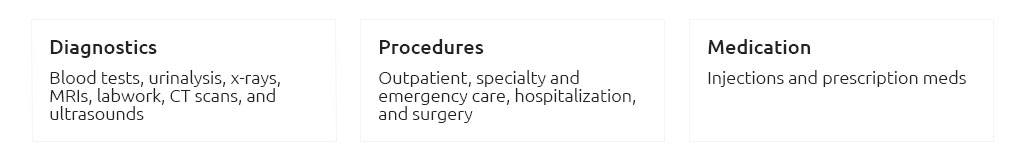

Renters Insurance for Dogs: What You Need to KnowAs a conscientious pet owner and responsible tenant, understanding the nuances of renters insurance is crucial. While many renters are familiar with the basic concept of renters insurance, which covers personal belongings and liability, there's a growing interest in how these policies intersect with pet ownership, particularly when it comes to dogs. This guide delves into the subtleties of renters insurance for dog owners, shedding light on common pitfalls and offering practical advice. Understanding Coverage Renters insurance, at its core, is designed to protect your personal property and provide liability coverage. But what happens when your furry friend is involved? Most renters policies include liability coverage for dog-related incidents, such as bites or property damage, which is essential for protecting yourself financially. However, not all policies are created equal, and some insurers might exclude certain breeds or have specific conditions. It's imperative to scrutinize the fine print and understand what is and isn't covered under your policy. Common Mistakes to Avoid

Practical Advice When shopping for renters insurance, transparency is key. Be upfront about your dog’s breed, age, and any behavioral issues. This honesty can help in securing the right coverage and avoiding claim denials. Additionally, consider investing in training for your dog, as a well-behaved pet not only reduces the risk of incidents but can also positively influence your insurance premiums. Ultimately, renters insurance for dog owners is about more than just ticking a box-it's a commitment to safeguarding your financial well-being while providing a safe, nurturing environment for your pet. By being informed and proactive, you can ensure that both you and your four-legged friend are protected. FAQs About Renters Insurance for DogsIs renters insurance mandatory for dog owners? Renters insurance is not legally required, but many landlords insist on it as a condition of the lease. It’s especially advisable for dog owners due to potential liability issues. Do all insurers cover dog-related incidents? Not all insurers provide coverage for dog-related incidents, and some exclude specific breeds. It’s essential to check your policy details or discuss with your insurer. Can I increase my liability coverage for my dog? Yes, many insurers offer the option to increase liability limits or add endorsements for greater coverage specific to pets. What happens if my policy doesn’t cover my dog's breed? If your policy excludes your dog’s breed, you may need to seek coverage from a specialized insurer that provides policies for high-risk breeds. How can I lower my renters insurance premium as a dog owner? Consider bundling policies, maintaining a good credit score, and investing in dog training to demonstrate responsible pet ownership, which can positively influence premiums. https://aasc.meyerandassoc.com/blog/pet-insurance/will-renters-insurance-cover-my-dog/

Liability coverage is standard on Renters insurance policies and helps pay for medical expenses if a guest sustains injuries in your home, including those ... https://www.candsins.com/blog/renters-insurance-with-a-dog/

Yes and no. Some insurance carriers will deny coverage for certain breeds of dogs. Some will offer you the coverage, but only after raising your premium. https://www.pawlicy.com/blog/does-renters-insurance-cover-dogs/

Dogs are covered under renters insurance, which protects both personal property and personal liability.

|